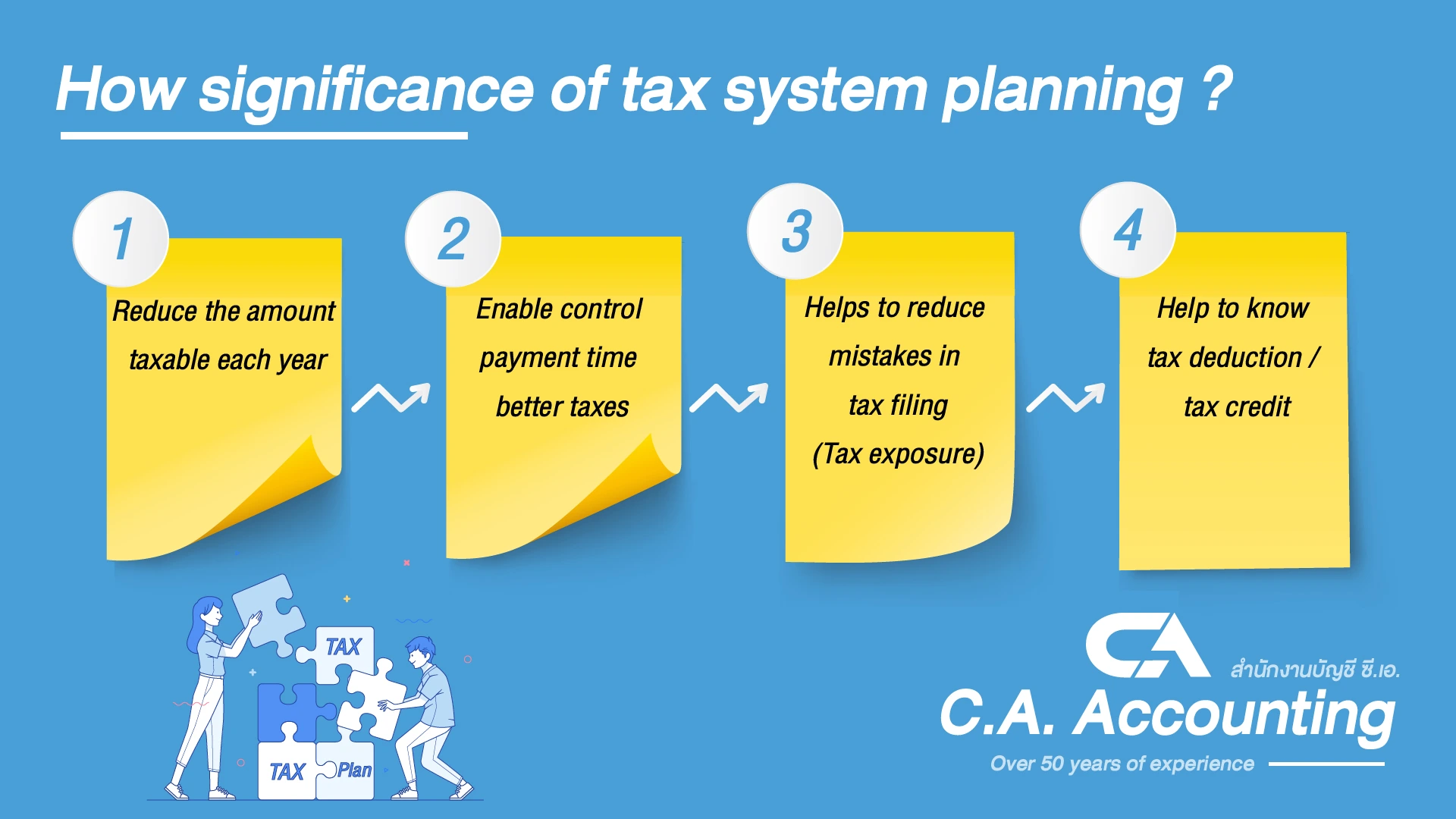

Tax system planning

Business achieves, If there is good tax planning

Confident in the quality of work

Tax system planning service details

Monthly tax service

- Preparing and filing withholding tax, such as. Por Ngor Dor 1, Por Ngor Dor2, Por Ngor Dor3 and Por Ngor Dor53

- Prepare and submit monthly social security contributions

- Preparation of monthly purchase-sales tax reports

- Submit vat Por Por30 and Por Por36

- Preparing and filing of specific business tax (Por Tor40)

Estimate and filing half year tax return

- Prepare half-year income tax returns for companies or juristic partnerships (Por Ngor Dor51)

- Preparation of a half-year personal income tax return Por Ngor Dor94

Estimating and filing annual tax returns

- Prepare annual income tax returns for companies or juristic partnerships (Por Ngor Dor50)

- Prepare annual personal income tax returns ( Por Ngor Dor91, Por Ngor Dor90)

- Preparation of withholding tax returns (Por Ngor Dor 1Gor, Por Ngor Dor2 Gor)

C.A.Accounting

Specialize in tax system planning, over 50 years of experience

Tax planning is another key to running a business if your business is profitable, as it can help show items for tax management quickly

So whether it’s a large or small business, if there is a tax plan, then it will be able to cope with tax burdens in a timely manner which helps to manage internal business more easily and reduce tax expenses as much as possible

In additional to accuracy compliance with legal requirements, C.A. Accounting specialize in tax planning for all business, so we aim to lighten the burden on the customer’s business for sustainable business goal

C.A.Accounting

455/37-38 Rama 6 Rd., Ratchathewi, Bangkok 10400

Tel : 094-659-5959

Tel : 02-215-0826

Tel : 02-215-0827

Line ID : @caaccounting

E-mail : [email protected]

Our services

Company & Partnership registration service

Accounting Service

Closing annual statement and Auditing Service

Accounting system implementation

Tax system planning

Payroll outsourcing